Mergers & Acquisitions: Private Equity Acquiring IdeaTek

UPDATE: FCC Grants Last Dance / Ideatek Section 214 Application

May 6, 2025 – The FCC’s Wireline Competition Bureau has granted the Section 214 application filed by Last Dance Intermediate III, LLC (Transferee) and IdeaTek Holdings, LLC (Transferor) which requested consent to transfer indirect control of IdeaTek Telcom, LLC (Licensee) from Transferor to Transferee. When the transaction is ultimately consummated, IdeaTek Telcom will be an indirect, wholly owned subsidiary of Last Dance Intermediate III, LLC.

March 7, 2025 – Last Dance Intermediate III, LLC (“Transferee”) and IdeaTek Holdings, LLC (“Transferor”) have filed a Section 214 application requesting FCC consent to transfer indirect control of IdeaTek Telcom, LLC (“Licensee”) from Transferor to Transferee.[1] The purchase price and other financial details have not been made public.

On March 27, 2025, the FCC’s Wireline Competition Bureau released a Public Notice seeking comment on the Section 214 application. Comments are due on or before April 10, 2025. Reply comments are due April 17, 2025. Because of the complexity of the proposed transaction, the Bureau has accepted the application for non-streamlined treatment. The FCC docket for the transaction is WC 25-129. The information below is sourced from the Section 214 application.

Private Equity Buyers

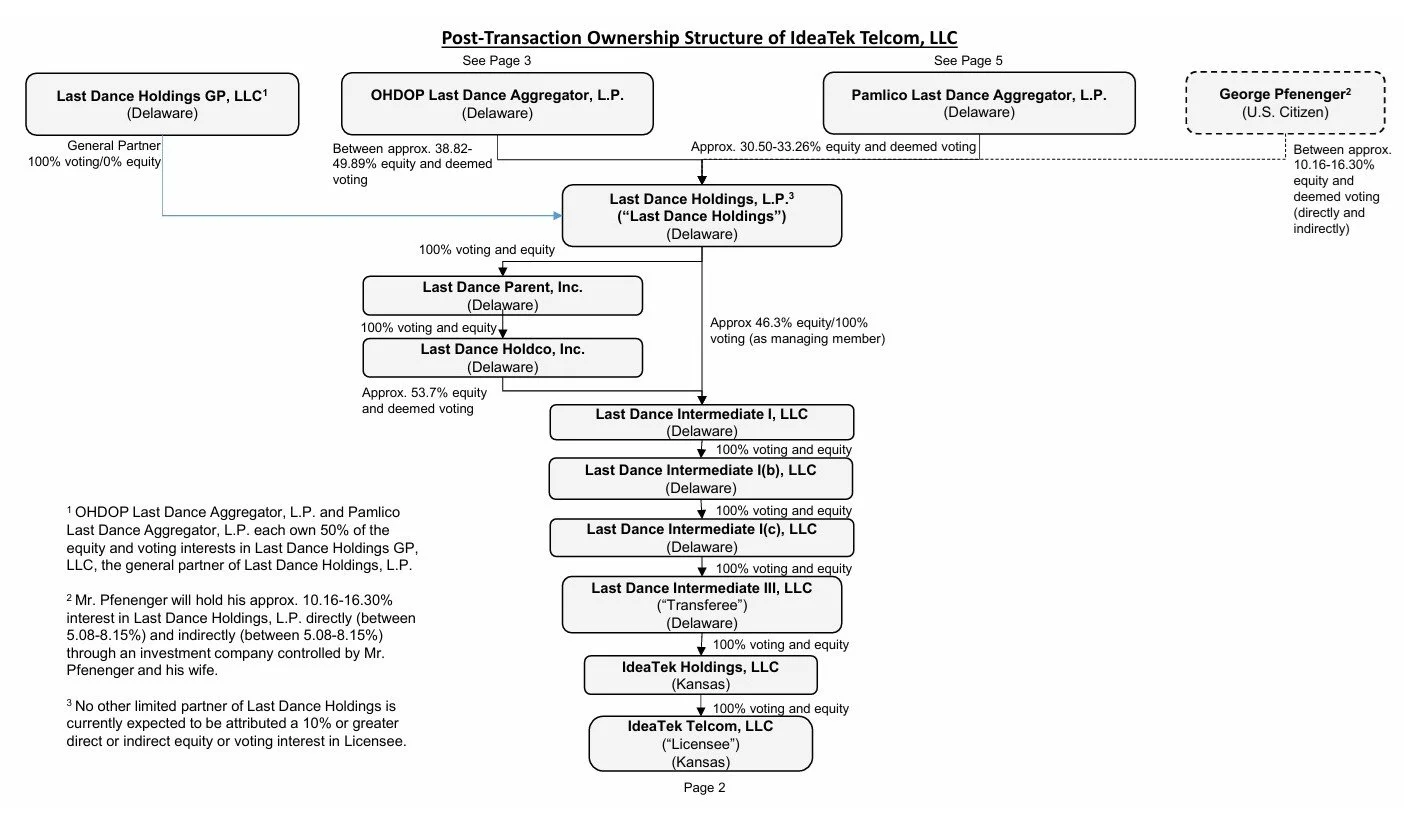

Last Dance Intermediate III, LLC is a newly formed Delaware limited liability company created for the purpose of completing the Transaction. Last Dance Intermediate III, LLC is indirectly, wholly owned by Last Dance Holdings, L.P. (“Last Dance Holdings”), an investment fund also created for the purpose of the Transaction.

Last Dance Holdings is primarily owned and controlled by funds and entities affiliated with Oak Hill Capital Management (“Oak Hill”) and Pamlico Capital Management (“Pamlico”), which are private equity funds based in the United States. The equity in the Oak Hill and Pamlico funds is held through passive limited (and insulated) partnership interests held by numerous, primarily U.S.-based investors, including individuals, trusts, institutions and business entities. Control of these funds ultimately rests in U.S. entities or citizens.

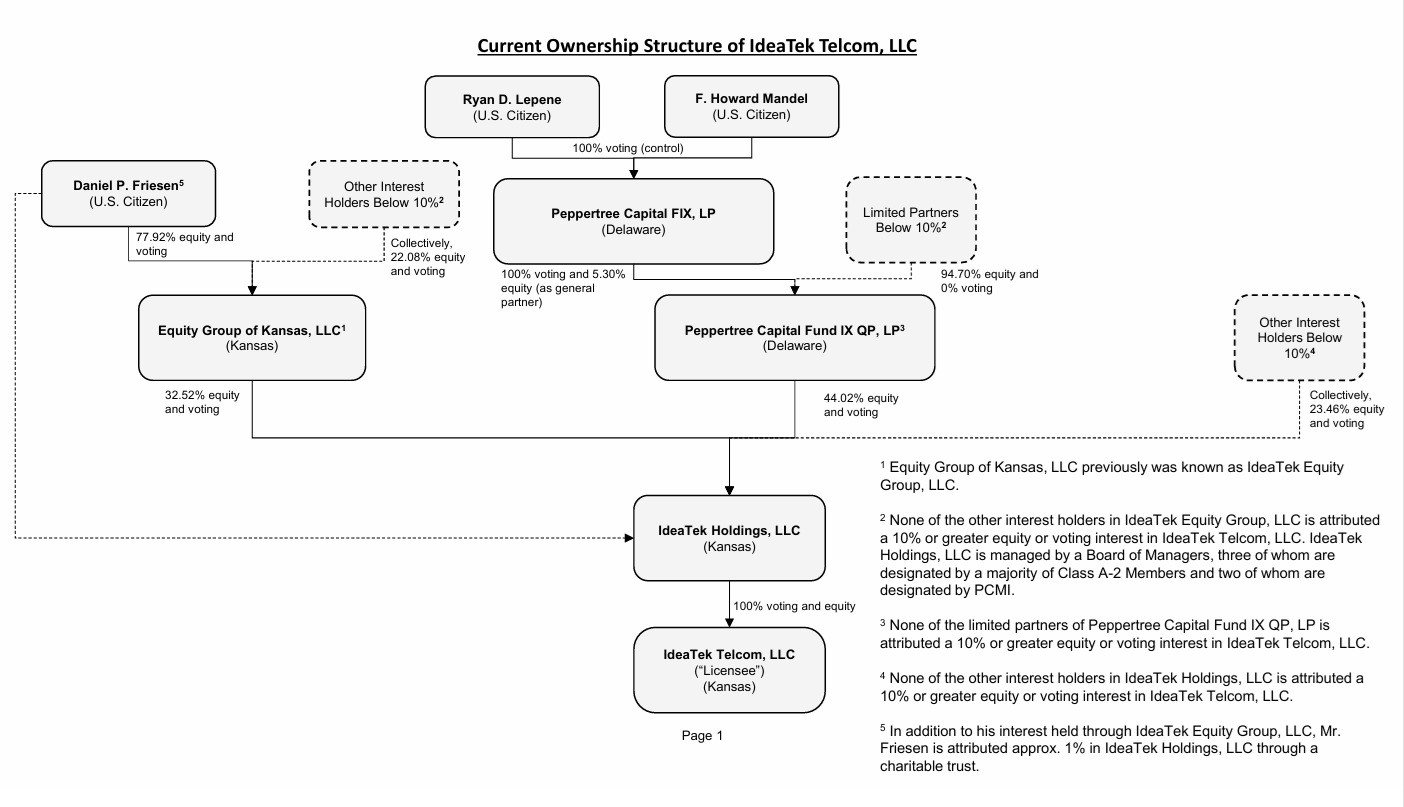

Current IdeaTek Ownership Structure

IdeaTek Holdings, LLC is a holding company that is owned by (1) Equity Group of Kansas, LLC (32.52% equity); (2) funds and entities controlled by Peppertree Capital Management, Inc. (44.02% equity); and (3) other interest holders below 10 percent (23.46%). Peppertree Capital acquired a majority interest in IdeaTek Telcom, LLC in December 2022 after it converted a prior significant debt investment into equity ownership.

Current Ownership Of IdeaTek Telecom, LLC, Application, Exhibit A, p. 1.

IdeaTek – Broadband & Telecom Provider

IdeaTek Telcom, LLC currently holds blanket domestic Section 214 authority to provide interstate telecommunications services and 75 wireless non-common carrier licenses issued by the FCC. IdeaTek Telcom, LLC primarily operates in Kansas, where it is authorized to provide local exchange and interexchange services and is designated as an Eligible Telecommunications Carrier (“ETC”). It is also authorized to provide local exchange, interexchange, and interconnected Voice over Internet Protocol (“VoIP”) services in Missouri.

In 2018, IdeaTek Telcom, LLC participated in the Connect America Fund (“CAF”) Phase II auction, and was the winning bidder for $5,163,189.74 to deploy broadband and voice services to 2,078 locations in Kansas. In June 2019, the FCC’s Wireline Competition Bureau authorized IdeaTek Telcom, LLC to receive CAF II auction support. Ideatek has certified deployment of voice and broadband service to approximately 98.51% of its CAF locations to date.

In 2020, IdeaTek Telcom, LLC participated in the FCC’s Rural Digital Opportunity Fund (“RDOF”) Phase I reverse auction, and was the winning bidder for $23,590.60 to deploy broadband and voice services to 89 locations in Kansas. It was authorized to receive RDOF support in March 2022.

Agreement And Plan Of Merger

Pursuant to an Agreement and Plan of Merger, dated as of February 22, 2025, by and among the parties, Transferee will acquire all of the outstanding voting and equity interests in Transferor. As a result of the Transaction, Licensee will become an indirect, wholly owned subsidiary of Transferee. Transferee will remain indirectly, wholly owned by Last Dance Holdings.

Public Interest Statement

The parties maintain that the transaction will serve the public interest, and will have no adverse impact on the customers or operations of Licensee. As for the benefits of the transaction, among other things, the parties have stated the following:

Additionally, following the Transaction, Licensee will continue to operate under experienced and knowledgeable management that the Commission has reviewed on three separate occasions. The Transaction will provide Licensee access to the financial resources and broader management expertise of Transferee and its ultimate owners. Oak Hill and Pamlico each have substantial experience investing in communications infrastructure assets, including numerous information and telecommunications service providers that are among the current and previous portfolio companies of Oak Hill and Pamlico funds. Licensee’s management will be able to benefit from this financial and operational expertise under Transferee’s ownership. Transferee seeks to build on Licensee’s existing network, support investment in new infrastructure, and continue to offer innovative and high-quality services to customers. Further, Transferee acknowledges that Licensee’s CAF Phase II and RDOF obligations will continue post-transaction and will ensure that Licensee continues to meet its CAF Phase II and RDOF obligations following the transaction. The proposed Transaction will enable Licensee to more efficiently and cost effectively satisfy its existing CAF Phase II and RDOF obligations and to expand its network and bring advanced communications services to additional consumers. Except for the enhanced management and financial resources that will become available to Licensee through Transferee and its owners following the Transaction, there will be no changes to the management, technology, or debt associated with Licensee’s CAF Phase II and RDOF funding that would compromise Licensee’s ability to meet its service obligations.[2]

Post-Transaction Ownership Of IdeaTek Telecom, LLC, Application, Exhibit A, p.2.

Oak Hill Capital Management – Other Telecom Investments

As previously mentioned, the Last Dance companies are ultimately owned and controlled by Oak Hill Capital Management and Pamlico Capital Management, which are private equity funds based in the U.S. Other related Oak Hill funds and entities currently hold a 10% or greater equity or voting interest in the following domestic telecommunications carriers:

Otelco, Inc. and subsidiaries – Otelco provides telecommunications services in Alabama, Maine, Massachusetts, Missouri, New Hampshire, Vermont and West Virginia through various subsidiaries.

Ontario Telephone Company, Inc., Trumansburg Telephone Company, Inc., and Finger Lakes Communications Group Inc. – Ontario and Trumansburg are rural local exchange carriers in New York that receive cost-based universal service support, while Finger Lakes is a resale provider of intrastate, interstate and international long distance within the areas served by Ontario and Trumansburg.

Netspeed, LLC – Netspeed provides high speed fiber-optic Internet services to residential and business customers in more than fifteen communities in Connecticut and Pennsylvania.

Race Telecommunications, LLC and its subsidiaries Bright Fiber Network, LLC, Race Technologies, LLC, AB2, LLC, and RaceTV, LLC – Race Telecom provides digital voice, video and fast Internet service in California. Bright Fiber operates a digital voice, video and Internet company in eastern Nevada County in California. Race Technologies provides the labor force for the Race family of companies. None of the Race entities receives high-cost USF support.

Metronet Holdings, LLC and its subsidiaries Metro Fibernet, LLC, Climax Telephone LLC, CMN-RUS, LLC, and Jaguar Communications – Metronet provides domestic and international telecommunications services, VoIP services, broadband services, or multichannel video programming services in certain portions of 18 states through various subsidiaries.

Related Transaction – Oak Hill & Pamlico Purchase Socket Telecom Of Missouri

In January 2025, Last Dance Intermediate II, LLC (“Transferee”) and Socket Holdings Corporation (“Transferor”) filed a Section 214 application requesting FCC consent to transfer indirect control of Socket Telecom, LLC (“Licensee”) from Transferor to Transferee. Last Dance Intermediate II, LLC is a newly formed Delaware limited liability company created for the purpose of completing the Transaction. Last Dance Intermediate II, LLC is indirectly, wholly owned by Last Dance Holdings, L.P. (“Last Dance Holdings”), an investment fund also created for the purpose of the Transaction. Last Dance Holdings is primarily owned and controlled by funds and entities affiliated with Oak Hill Capital Management and Pamlico Capital Management. Socket Telecom, a Missouri LCC, provides competitive telecommunications services primarily in Missouri, and is wholly owned by Socket Holdings. Socket Telecom is authorized to provide local exchange and interexchange services in Arkansas, Kansas, Missouri, and Oklahoma. Socket Telecom is designated as an Eligible Telecommunications Carrier (ETC) in Missouri and has been authorized to receive $232,768.80 in Rural Digital Opportunity Fund (RDOF) support to serve 393 locations in Missouri. On March 13, 2025, the FCC granted the application.

*****

[1] Application of Last Dance Intermediate III, LLC, Transferee, and IdeaTek Holdings, LLC, Transferor, For Consent to Transfer Indirect Control of IdeaTek Telcom, LLC, Holder of Domestic Authority Pursuant to Section 214 Under the Communications Act of 1934, as Amended, to Last Dance Intermediate III, LLC; WC Docket 25-129, Application (filed Mar. 7, 2025), https://www.fcc.gov/ecfs/document/10307088082331/1.

[2] Application at p. 6.