Mergers & Acquisitions: Private Equity Acquiring Elkhart Telephone Company & Epic Touch (Kansas)

October 1, 2025 – The private equity funds that own IdeaTek Telcom, LLC (IdeaTek) have entered into an agreement to acquire Elkhart Telephone Company, Inc. (Elkhart Telephone) and Epic Touch Co. (Epic Touch). The parties have filed transfer of control applications with the Federal Communications Commission (FCC)[1] and the Kansas Corporation Commission (KCC).[2] The purchase price and other terms of the agreement were not disclosed. The deal is expected to close in early 2026, and is subject to regulatory approvals.

The Transaction – Stock Purchase Agreement

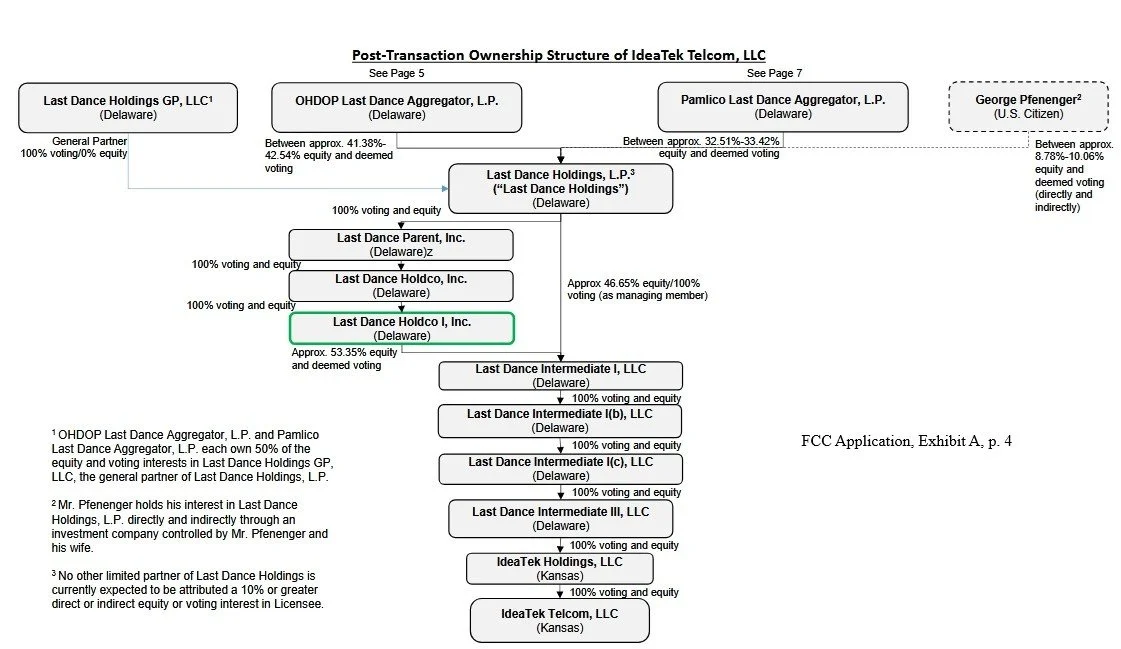

Pursuant to a September 15, 2025 stock purchase agreement, Last Dance Holdco, Inc., which is primarily owned and controlled by funds and entities affiliated with Oak Hill Capital Management and Pamlico Capital Management, will acquire all of the outstanding voting and equity stock of Epic Touch. Elkhart Telephone is a wholly owned subsidiary of Epic Touch.

Immediately after the transaction closes, both Epic Touch and Elkhart Telephone are expected to convert to Delaware limited liability companies (Epic Touch Holdings, LCC and Elkhart Telephone Company, LLC). Thereafter, all of the equity ownership interests in both companies will be transferred to IdeaTek. As a result of that pro forma ownership transfer, Epic Touch will be a direct wholly owned subsidiary of IdeaTek, and Elkhart Telephone will be an indirect wholly owned subsidiary of IdeaTek. Here is how the transaction is described in the KCC application:

For federal income tax reasons, the stock of Epic Touch will be purchased by Last Dance Holdco, Inc., an indirect parent company of IdeaTek. Immediately prior to the closing, Elkhart Telephone will convert from a corporation to a limited liability company. Last Dance Holdco, Inc. will form a new, wholly-owned subsidiary, Last Dance Holdco I, Inc. Immediately after closing, Last Dance Holdco, Inc. will contribute 100% of the shares of Epic Touch to Last Dance Holdco I, Inc. and Epic Touch will convert into a limited liability company. Immediately after the LLC conversion, Last Dance Holdco I, Inc. will contribute 100% of the interests in Epic Touch down the entity chain such that it is held by IdeaTek.[3]

The Parties – Epic Touch Co. & Elkhart Telephone Company, Inc.

The Bob Boaldin Revocable Trust, Dian Boaldin Revocable Trust, Bob Boaldin Irrevocable Epic Trust, and Dian Boaldin Irrevocable Epic Trust own Epic Touch Co., which wholly owns Elkhart Telephone. Elkhart Telephone has been a family-owned communications provider since its inception in 1956. It operates as an incumbent local exchange carrier (ILEC) that provides telecommunication and broadband services in Elkhart, Kansas and surrounding areas in southwest Kansas. Elkhart Telephone receives CAF-Broadband Loop Support (CAF-BLS) and High-Cost Loop Support from the universal service fund. Epic Touch provides competitive telecommunications and broadband services under the Epic Touch brand in Liberal, Kansas and other areas in southwest Kansas.

Map of Elkhart Telephone’s ILEC service area.

The Parties – IdeaTek Telcom, LLC

Ideatek is directly, wholly owned by IdeaTek Holdings, which is directly wholly owned by Last Dance Intermediate III, LLC (LDI), a Delaware limited liability company and investment fund created for the purpose of purchasing Ideatek in March 2025. LDI is indirectly and wholly owned by Last Dance Holdings, L.P. (LDH), a Delaware limited partnership and investment fund. LDH is primarily owned and controlled by funds and entities affiliated with Oak Hill Capital Management and Pamlico Capital Management, which are private equity funds based in the United States.[4]

IdeaTek currently holds blanket domestic Section 214 authority to provide interstate telecommunications services and 75 wireless non-common carrier licenses issued by the FCC. IdeaTek primarily operates in Kansas, where it is authorized to provide local exchange and interexchange services and is designated as an Eligible Telecommunications Carrier (ETC). It is also authorized to provide local exchange, interexchange, and interconnected Voice over Internet Protocol (VoIP) services in Missouri.

In 2018, IdeaTek participated in the Connect America Fund (CAF) Phase II auction, and was the winning bidder for $5,163,189.74 to deploy broadband and voice services to 2,078 locations in Kansas. In June 2019, the FCC’s Wireline Competition Bureau authorized IdeaTek to receive CAF II auction support. Ideatek has certified deployment of voice and broadband service to approximately 98.51% of its CAF locations to date.

In 2020, IdeaTek participated in the FCC’s Rural Digital Opportunity Fund (RDOF) Phase I reverse auction, and was the winning bidder for $23,590.60 to deploy broadband and voice services to 89 locations in Kansas. It was authorized to receive RDOF support in March 2022.

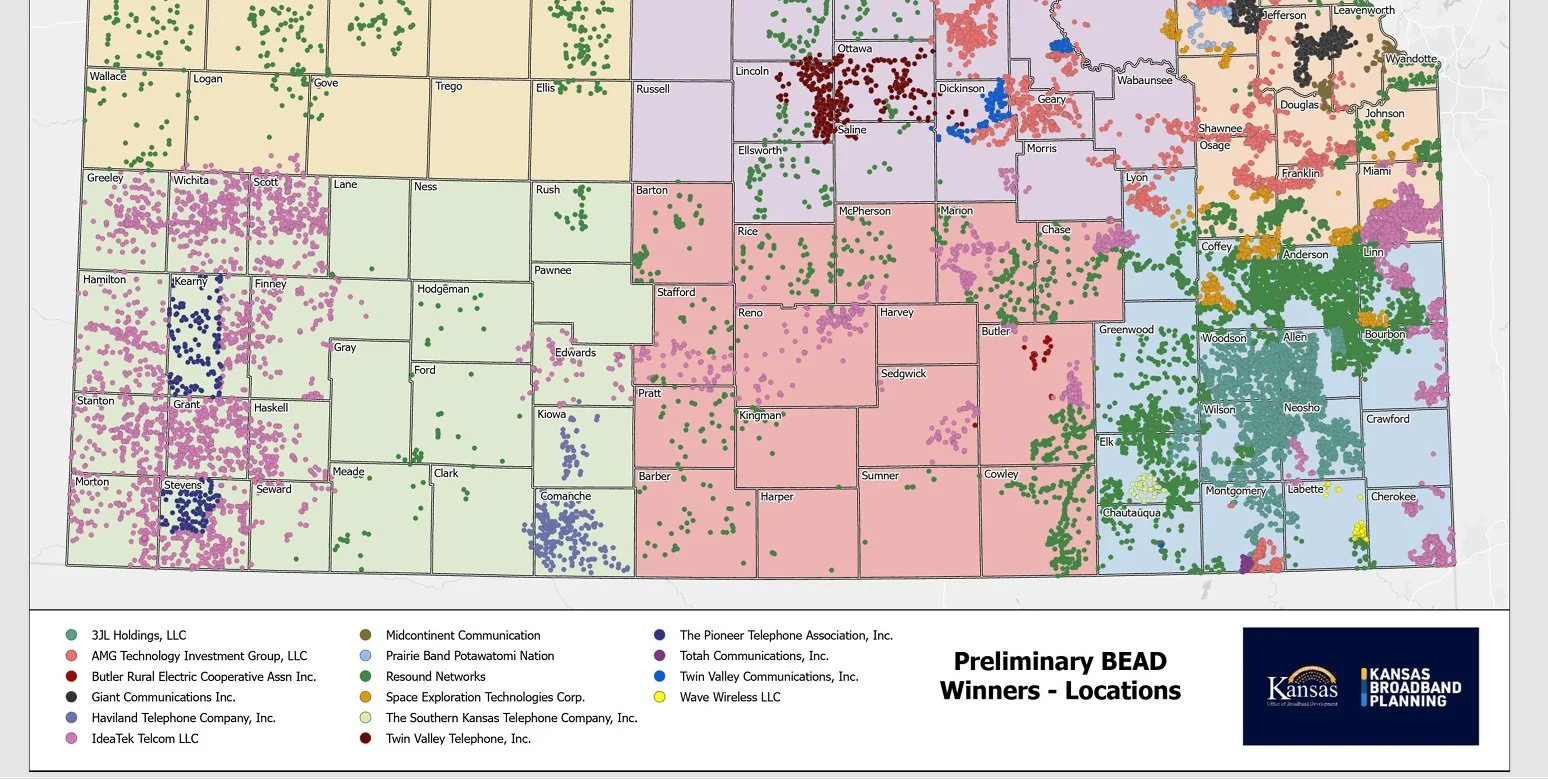

IdeaTek was the biggest preliminary winner of Broadband Equity, Access, and Deployment (BEAD) program funding in Kansas. IdeaTek was preliminarily awarded $115,890,548 to serve 7,419 locations in Kansas.

Kansas Corporation Commission Application

On October 1, 2025, Elkhart Telephone and IdeaTek filed a joint application requesting that the KCC approve IdeaTek’s acquisition of Elkhart Telephone. The parties have requested expeditious approval of the application, and waiver of any notice, publication, or hearing requirements. The KCC Docket Number for the proceeding is 26-ELKT-109-ACQ.

In the joint application, the parties explain that the transaction “is in the public interest because it meets the Commission’s standards for mergers and acquisitions of Kansas public utilities.” In support, the parties have included the following details on the effects of the transaction:

It is the intent of IdeaTek to continue to provide service under the Elkhart Telephone name for a period of time after the transaction closes.

The transaction will not result in any changes to the day-to-day operations of Elkhart Telephone.

Aside from certain executive-level personnel changes no substantive changes will be made to Elkhart Telephone as a result of this transaction.

Present employees of Elkhart Telephone will continue in their roles of providing service to customers.

The transaction will not result in any changes to the rates, terms, or conditions of service for Kansas customers, nor will it cause any service disruption.

Elkhart Telephone anticipates it will continue to provide high quality communications service, with enhancements from IdeaTek’s additional resources.

IdeaTek commits that it will adequately capitalize Elkhart Telephone and ensure that the company has the capital necessary to carry out its obligations.

The transaction will be financed entirely by cash (through both cash on hand and by drawing on existing debt financing) as detailed in the Stock Purchase Agreement.

Federal Communications Commission Application

On September 29, 2025, the parties filed a Section 214 application requesting that the FCC approve the transfer of control of Elkhart Telephone and Epic Touch to IdeaTek. In their joint application, the parties explain that the proposed transaction will serve the public interest, based on, among other things, the following:

Following the transaction, Elkhart Telephone will continue to operate under Ideatek’s experienced and knowledgeable management that the FCC has reviewed on a number of prior occasions;

Oak Hill and Pamlico each have substantial experience investing in communications infrastructure assets, including numerous information and telecommunications service providers that are among the current and previous portfolio companies of Oak Hill and Pamlico funds;

Elkhart Telephone will be able to benefit from Oak Hill and Pamlico and financial and operational expertise under IdeaTek’s ownership;

IdeaTek’ seeks to build on Elkhart Telephone’ existing network, support investment in new infrastructure, and continue to offer innovative and high-quality services to customers;

The Transaction will not result in any changes to management, technology, debt, or other matters that would compromise the support recipients’ ability to meet their service obligations under the high-cost and Lifeline programs, as well as other responsibilities as an ETC designee or under the FCC’s rules and the Communications Act;

IdeaTek plans to use its administrative, managerial and technical resources to ensure compliance with and completion of Epic Touch’s high-cost obligations;

The transaction will have no adverse impact on the customers or operations of Elkhart Telephone, the transaction will not result in service disruption, contract termination, or customer confusion, and upon closing of the transaction, IdeaTek plans to continue to provide Elkhart Telephone’s services at the same rates, terms, and conditions, as governed by existing contracts, as applicable, without changes to service offerings, billing or other aspects of service to current customers; and

The only change immediately following the closing from a customer’s perspective will be the new upstream ownership of Elkhart Telephone, as well as the company’s access to additional financial resources and broader management expertise.

Post-transaction ownership structure of Elkhart Telephone.

Post-transaction ownership structure of IdeaTek.

*****

[1] Transfer of Control of Epic Touch Co., Inc. and Elkhart Telephone Company, Inc., Holder of Domestic Authority Pursuant to Section 214 of the Communications Act of 1934, as Amended, to IdeaTek Telecom, LLC, WC Docket No. 25-301, Application For Transfer Of Control Of Domestic Section 214 Authorization (Sep. 30, 2025) (FCC Application), https://www.fcc.gov/ecfs/document/1092963081000/1.

[2] Transfer of Ownership of Elkhart Telephone Company, Inc. to IdeaTek Telcom, LLC., KCC Docket No. 26-ELKT-109-ACQ, Joint Application And Request For Procedural Waivers (Oct. 1, 2025) (KCC Application), https://estar.kcc.ks.gov/estar/ViewFile.aspx/S202510011204532390.pdf?Id=57a6d369-bf59-477c-9eb5-84de453f4dd2.

[3] KCC Application at ¶ 2.

[4] KCC Application at ¶ 14.