KCC Telecom Staff Replies To Ideatek Telcom’s Response Disputing KUSF Audit Report

July 3, 2025 – The Kansas Corporation Commission’s (KCC or Commission) telecom Staff has submitted a reply[1] to IdeaTek Telcom, LLC’s (IdeaTek or Company) response challenging the results of a Kansas Universal Service Fund (KUSF) Fiscal Year 27 (FY27) audit. The KCC docket number for the proceeding is 25-WLDT-100-KSF.

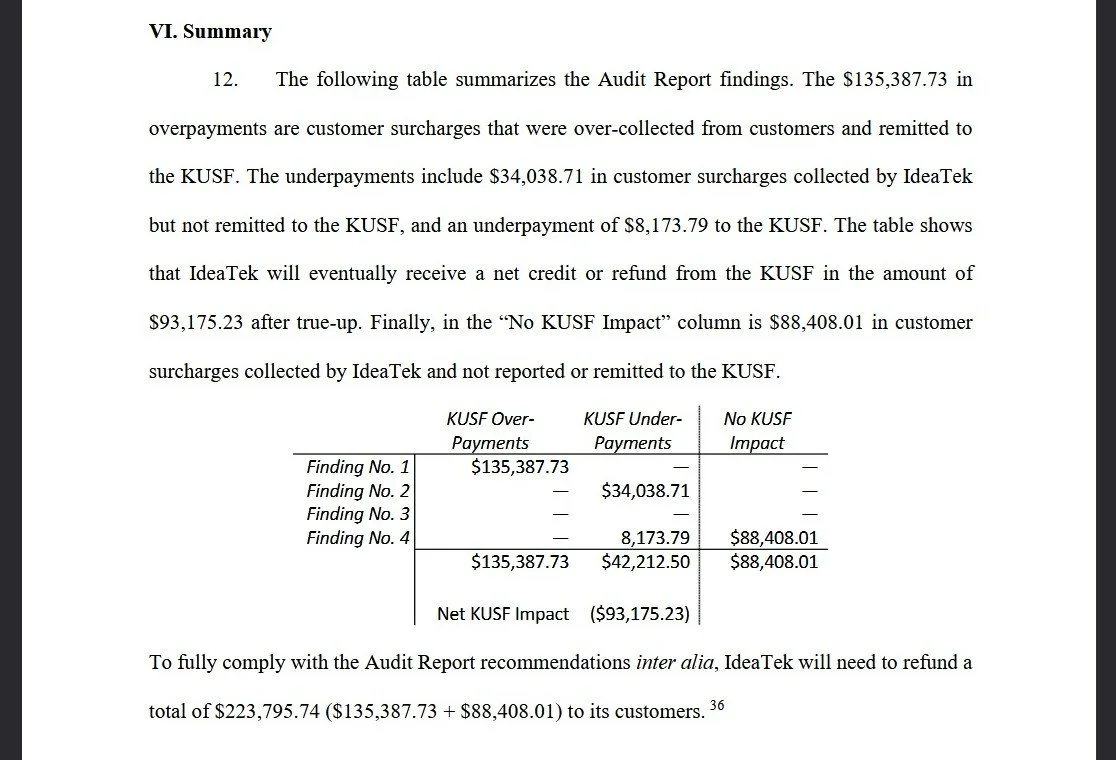

On June 12, 2025, the KUSF administrator, VantagePoint Solutions, Inc. (Vantage Point or VPS), filed a report on the results of its KUSF audit of IdeaTek which found that IdeaTek failed to comply with certain KUSF assessment and contribution rules. Thereafter, IdeaTek submitted a response disagreeing with some of the interpretations underlying certain findings in the audit report.[2] IdeaTek further claimed that its “objections and arguments have not previously been presented to the Commission for specific consideration.” Its arguments are summarized in the following bullet points:

IdeaTek should be allowed to recover from the KUSF any amounts it is ordered to refund to customers for past collections on non-assessable revenues;

IdeaTek is not required to include in its KUSF assessable revenues Late Fees, Compliance Fees, Regulatory Fees, and Manual Billing Processing Fees because these revenues are not assessed by the FCC for IdeaTek’s contribution to the federal universal service fund (FUSF), and they are not telecommunications services under Kansas law and Commission order;

IdeaTek’s practice of adjusting its KUSF assessment using a monthly internal true-up complies with Kansas law; and

Any amounts owed by IdeaTek to the KUSF should be offset by amounts due to IdeaTek from the KUSF.

In its reply to IdeaTek’s response, Staff rejects each IdeaTek argument, and ultimately recommends that the Commission adopt Vantage Point’s audit report. Staff’s arguments addressing each individual audit finding and IdeaTek claim are summarized below:

Audit Finding No. 1

Standard – Non-voice service revenues will not be included in carriers’ retail revenues.

Finding – IdeaTek reported and collected the KUSF surcharge on the following non assessable revenues: Alarm Lines, Fax Lines, EFax, EFax Service + ATA, MessageView (SMS Services), Mid America Computer Corp, Subscriber Line Charge, Subscriber Multi-Line Charge, PRI (Phone equipment), Elan & Eline Services, Intrastate Private Line Data Circuits revenue, and Interstate Private Line Data Circuit revenue. This resulted in the Company over-reporting and over-paying the KUSF assessment, and over-collecting the KUSF surcharge by $135,387.73

Staff Characterization Of IdeaTek Contention 1: IdeaTek should be allowed to recover from the KUSF any amounts it is ordered to refund to customers for past collections on non-assessable revenues.

Staff Response 1: This contention is addressed in the Audit Report in Audit Finding No. 1. IdeaTek is correct that the Company reported and collected the KUSF surcharge on certain non-assessable services and then reported them as intrastate revenues from March 2022–February 2025. The Company over-collected $135,387.73 from its customers and overpaid its KUSF contributions by $135,387.73. IdeaTek is eligible for a credit or refund from the KUSF in the amount of $135,387.73; the Company has not been prohibited from obtaining a refund as contended. However, because the total amount IdeaTek over-collected from its customers is $223,795.74, the $135,387.73 is subtracted (offset) from that amount leaving $88,408.01 that was over-collected from the Company’s customers but was not remitted to the KUSF. IdeaTek must comply by filing true-ups for KUSF years 26–28 as required by the Audit Report to ensure “[a]ny contributions in excess of distributions collected in any reporting year shall be applied,” before a credit or refund for an excess remittance from the KUSF may occur.

Audit Finding No. 2

Standard – Companies are required to report their intrastate retail revenues, including non-recurring and miscellaneous revenues, to the KUSF.

Finding – IdeaTek did not report the following assessable revenues to the KUSF: Late Fees, Compliance Fees, Regulatory Fees, and Manual Billing Processing Fees. This resulted in the Company under-reporting and under-paying the KUSF assessment by $34,038.71.

Staff Characterization Of IdeaTek Contention 2: IdeaTek is not required to include its KUSF assessable revenues Late Fees, Compliance Fees, Regulatory Fees, and Manual Billing Processing Fees because these revenues are not assessed by the FCC for IdeaTek’s contribution to the federal universal service fund (FUSF), and they are not telecommunications services under Kansas law and Commission order.

Staff Response 2: IdeaTek indicates that it uses the same allocation methodology for FUSF and KUSF contributions, and reports revenue and remits assessments to the KUSF based upon the unbundled price of the assessable service. The Commission has determined that the methodology IdeaTek uses is a “safe harbor” methodology, as such it is deemed reasonable for KUSF compliance purposes. This safe harbor methodology determines the allocation of interstate and intrastate revenues. Interstate revenues are reported to the FUSF. Any inverse revenues are ipso facto allocated as the intrastate contribution to KUSF. Contribution methodology does not refer to whether a revenue type is reported, rather it refers to how the allocation between interstate and intrastate reported revenues is made (in this case, safe harbor)…Contrary to IdeaTek’s contention, the Commission has previously determined that late fees, billing fees, and other customer fees are telecommunications services fees and that they are reportable by telecommunications carriers to the KUSF. As a VoIP provider, IdeaTek is required to contribute to the KUSF on an equitable and nondiscriminatory basis.

Audit Finding No. 3

Standard – Any telecommunications carrier, telecommunications public utility, wireless telecommunications service provider or provider of interconnected VoIP service which contributes to the KUSF may collect from customers an amount equal to such carrier’s, utility’s, or provider’s contribution, but such carrier, provider or utility may collect a lesser amount from its customer.

Finding No. 3 – IdeaTek over-collected the KUSF surcharge from customers in some months to recover under-collection of the KUSF surcharge in other months. This resulted in the Company over-collecting its KUSF assessment by $88,408.01.

Staff Characterization Of IdeaTek Contention 3: IdeaTek’s practice of adjusting its KUSF assessment using a monthly internal true-up complies with Kansas law.

Staff Response 3: Pursuant to K.S.A. 66-2008(a) IdeaTek is allowed to collect an amount equal to or less than its KUSF assessment from its customers and does so. IdeaTek explains that there are many accounting or billing challenges to align recovery of the KUSF surcharge on a monthly basis and that K.S.A. 66-2008(a) does not state that monthly collections must be equal to or less than fees paid for that month. However, IdeaTek’s “monthly internal true-up” is intentionally charging a different rate in any given month from the 11.37% authorized rate as ordered by the Commission for KUSF year 27. VPS, the KUSF administrator, considered the over-collection of the assessment rates in some months as billing system limitations and recommended IdeaTek’s billing system be updated to correct customer surcharge over-billing in any single billing period. As it stands, IdeaTek over-collected $88,408.01 from customers during the period March 2022-February 2025 through their “monthly internal true-up” which was not remitted to the KUSF. The net result of IdeaTek’s implementation of a monthly internal true-up violates K.S.A. 66-2008(a) by over-collecting the Commission's approved assessment rate.

Audit Finding No. 4

Standard – Include only intrastate retail revenue that was not collected from customers and was actually written-off by the company during this revenue data month reported.

Finding – IdeaTek included assessable and non-assessable revenues in its write-offs that were reported on its monthly carrier remittance worksheets (CRWs). This resulted in the Company under-reporting its revenue and under-paying it KUSF assessment by $8,173.79.

Staff Characterization Of IdeaTek Contention 4: Any amounts owed by IdeaTek to the KUSF should be offset by amounts due to IdeaTek from the KUSF.

Staff Response 4: Staff concurs with IdeaTek’s response to Audit Finding No. 4 including that IdeaTek reported assessable and non-assessable revenues in its write-offs that were reported on its monthly CRWs resulting in the Company under-reporting its revenue and underpaying its KUSF assessment by $8,173.79.